Financial Dance on the Waves of Growth

Inflation has various economic consequences, and it also affects stock investments. Let's take a closer look at how inflation can positively impact corporate performance and the value of stocks.

- 1. Revenue Growth: The Sweet Fruits of Price Increases

The general rise in prices due to inflation presents a unique opportunity for companies. As the prices of products and services increase, so do the revenues of companies. The key here is how well companies can adapt to inflation and position their products and services to benefit from market price increases. Successful adaptation can lead to an increase in operating profit.

- 2. Value Appreciation: Contributing to Market Value

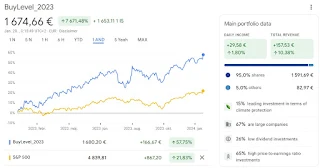

Inflation-inflated prices and higher revenues both affect the market value of companies' securities. Stock prices may rise as investors recognize the growing potential of companies in an inflationary environment. Thus, shareholders can benefit from the positive effects of inflation through an increase in the value of their portfolios.

- 3. Impact of Price Increases: Profits in the Black

Price increases can not only boost company revenues but also improve profitability. Companies have the opportunity to raise prices, resulting in an improved profit margin. Market participants often react positively to the stocks of companies that effectively implement price increases, as this signifies growing profits and value for shareholders.

- Conclusion

Inflation is not just a general economic indicator; it offers numerous opportunities for investors. Through adept management of companies and flexible adaptation to market trends, shareholders can benefit from the positive effects of inflation. However, it's crucial for investors to consistently monitor the inflationary environment and consciously diversify their portfolios to mitigate potential risks.

No comments:

Post a Comment